Bwog Finance is almost a weekly column at this point…Get hype for our latest post, “How To Make A Budget Using Excel.” It might seem kind of obvious, but we know (some) of you will be needing it when allowance money runs out after college. Also, we now have a listserv dedicated to financial problems. Email us your query to finance@bwog.com and we’ll write a column on it.

(Is this column a joke, or is it real? [Not the column as a whole, but the specific topic]). This is a real column. Budgeting is hard without an Excel sheet. And using Excel is hard if your purported knowledge doesn’t extend past your résumé. Today we’re going to learn how to make a basic budget using excel.

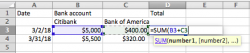

First, give Column A the title “Date.” (Remember, a column is the one that goes up-and-down and a row is side-to-side). Second, give Column B the title “Bank Account.” If you have more than one bank account (e.g., savings and checking) you can make subtitles under “Bank Account” with each bank’s name (e.g., Citibank, Bank of America). In the next available column (will vary depending on number of bank accounts you own), write “Total.”

Now, under date, put today’s date. Check the amounts in your bank accounts, and put those amounts under each bank subtitle. Under total, tally together the amounts in each bank account. You can do this by using the SUM function. Enter “=SUM” and you’ll be able to select which cells (i.e., box) to add together. See figure 1 below. Repeat this process at least twice a month, and the beginning and end.

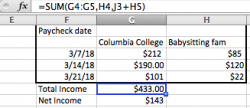

On to the next part of your budget! Move over a few columns, let’s say, to column F, and give this column the title “Paycheck date.” In column G, give it the title of your employer (e.g., Columbia College Call Center). If you have more than one employer, good for you. Add that employer’s name under column H (e.g., Babysitting Family). At the end of each month, add a row that says “Total Income.” In the next column over, write down what your total income is for the month. Again, you can use the SUM function to do this. Finally, add another row below and write “Net Income.” We’ll learn about how to calculate this next. See figure 2 below.

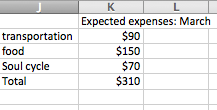

Here’s the fun part! Find out how much $$ you spend each month. A great way to do this is to go through your bank statements, and divide purchases by type (e.g., transportation [uber, MTA], food, entertainment, clothes, etc). Then count up how much you spend a month on these things. Average together your totals in each category for the past few months. This will be your monthly expected expenditures. So, move on over to column J and fill in the rows below J with the categories you come up with. Transportation, food, school supplies, whatever. Next to each category, write what you expect to spend each month in that category. Then add a row at the bottom that says “Total.” For your Net Income in Column G, you will subtract your expenses from your total income. To do this, enter “=(cell1-cell2)”, where cell1 is total income and cell2 is total expenses. See figure 3 below.

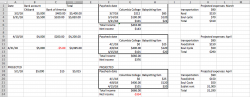

Woohoo! And that’s it. Finance Forever! Just repeat this every month. Now you know how much you spend/make each month, and you can predict future months (like for the summer!) See figure 4.

The coolest thing about excel is that if you ever go below zero dollars, that amount appears in red. Ok! Get budgeting! And send us your ideas for more Bwog Finance columns!

- Figure 1

- Figure 2

- Figure 3

- Figure 4

2 Comments

2 Comments

2 Comments

@sarah's real #1 fan i’ve been here since the beginning and i still stan

@sarah's #1 fan sarah these r some str8 money moves !!1