Bwog helps you pick the most cost-effective meal plan, using math.

Last year, Bwog helped you pick a meal plan qualitatively. This year, we are ramping it up with cold hard arithmetic. If you are stuck choosing plans, let numbers help you!

First, let’s calculate how many meals you actually need per term. There are 108 days in a term, so multiply the number of meals you expect to have per day by 108. For the sake of this math, I’ll say a student will eat two dining hall meals a day. With 2 meals a day, for 108 days, the average student will eat 216 meals per semester, and this is the number I will use throughout in my math, but note that it is dependent on the user.

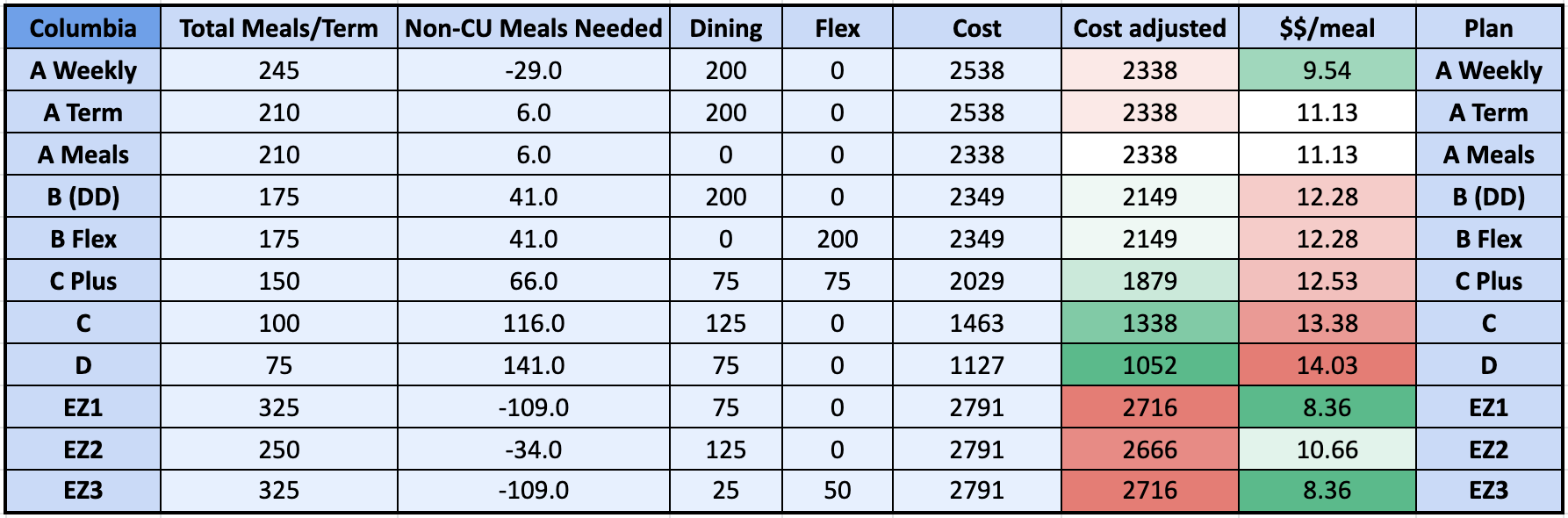

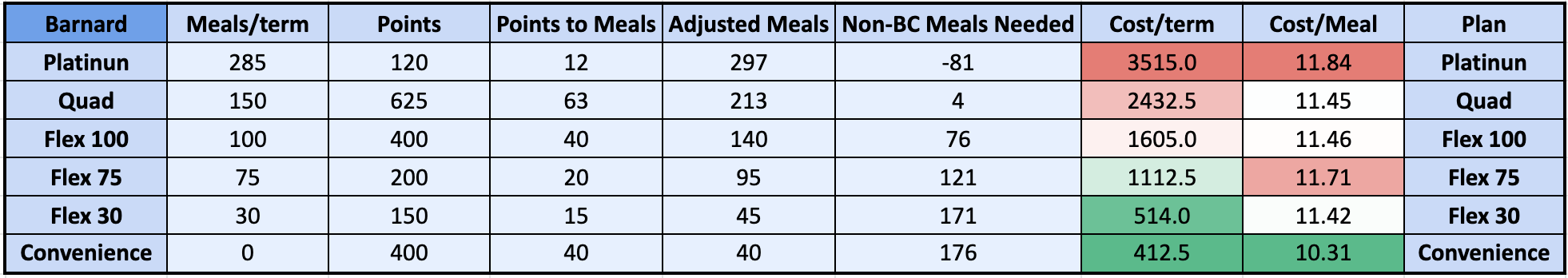

So, given that, here’s a bunch of numbers:

Some notes about these tables:

Cost-adjusted for Columbia means Total Cost – Dining Dollars and Flex. We are looking at what you will be paying/meal, which doesn’t include the price of Dining Dollar and Flex.

Meals Adjusted for Barnard means meals from your dining plan + Points-to-Meals

Points to Meals: I assumed that all points will be spent on meals, with an average meal costing 10 points. This column shows how many meals you get from your points

Non-CU/BC Meals Needed means how many meals you are going to have to procure from outside the dining halls. A negative number is the number of meals you will have left at the end of the semester (given you eat 216 meals a term).

Color code: red is more expensive, green is cheaper, and they fade between each other so white is the perfect middle. The blue is just for aesthetics.

So, let’s analyze this a little.

Columbia: Expectedly, the EZ meals are the most expensive, and the C and D meals are the least expensive overall. But per meal, the EZ meals end up being the cheapest. This means that if you are planning on eating a lot in the dining halls (athletes, looking at you!), the EZ meals are the most cost-efficient. You end up paying $8.36 per meal, which is absurdly cheap for New York. On the other hand, if you have a nice kitchen, and a desire to cook, one of the C or D meals benefits you. Even if you have to pay an occasionally higher price for food, you are still saving money with a cheaper meal plan. If you’re a person in the middle – expecting to cook some, take out some, and eat some in the dining halls, then plan A is your best bet. You have the most cost-effective meals without a very expensive plan. Meal plan B overall seems bad on both ends: it is both expensive per meal, and overall. Unless you know you’re going to be eating more than two dining hall meals a day (that’s breakfast lunch and dinner, even on weekends!), plan B is not worth your money.

Barnard: Barnard’s meal plans are very different from Columbia’s. Basically all the meals end up costing the same per meal, with only $1.40 difference between the most cost-ineffective plan (Flex 75) and the most cost-effective plan (Convenience). For Barnard, your decision should be quite easy: buy the amount of meals you plan to eat. If you can cook and you’re going to be living somewhere with a nice kitchen, Convenience is your most cost-effective option – the price per meal and cost per term is the lowest.

•

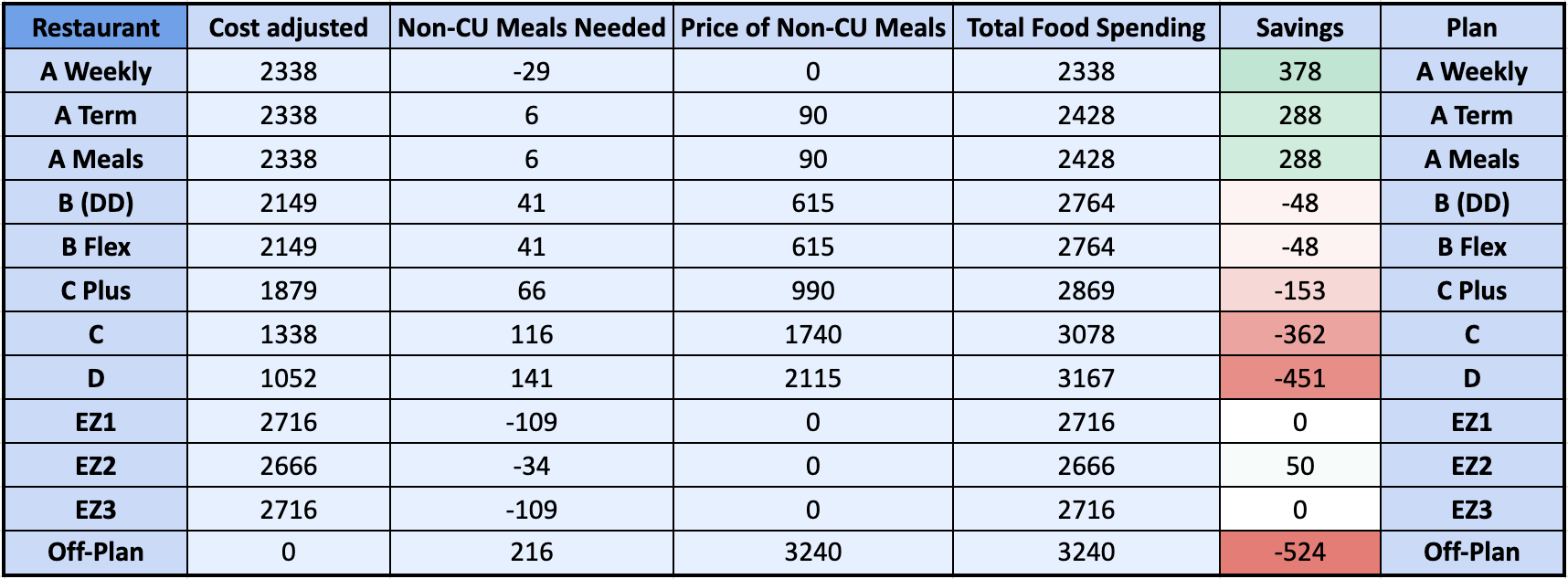

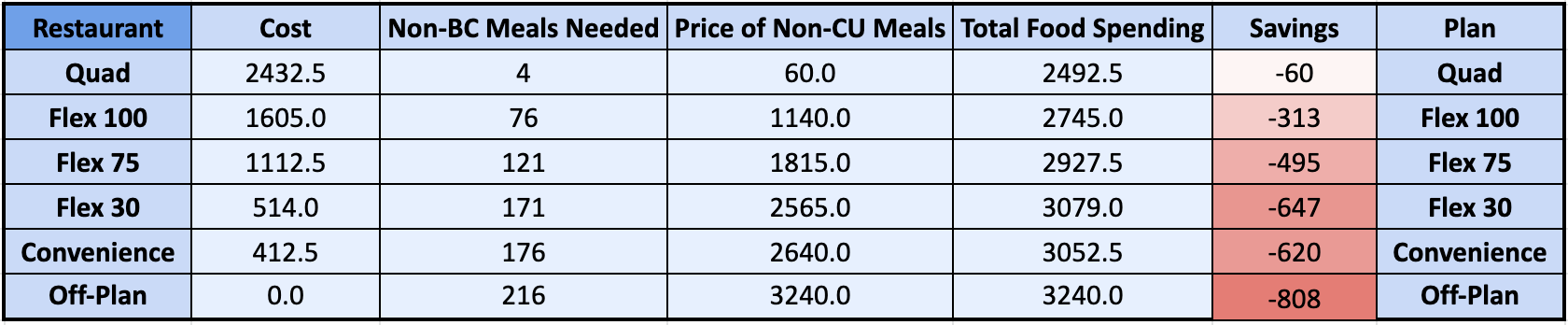

But now the real spreadsheet geek in me comes out. Because how much money are you saving? For this, you need two numbers: how much you could be spending and how much you are spending.

For Columbia, I will use the most expensive meal plan, EZ1 as my benchmark for the most you could spend on food, and for Barnard, I’ll use the Quad plan.

As for how much you do spend, there are two options.

Option 1: Restaurants. You don’t like cooking, don’t have a kitchen, or just like to go out. If you are spending money on food, it’s on prepared food from restaurants. For the sake of math, I’ll say the average meal in NYC is $15, which is factoring in both a nicer $25 sit-down meal, but also a quick bite from Strokos. Given this…

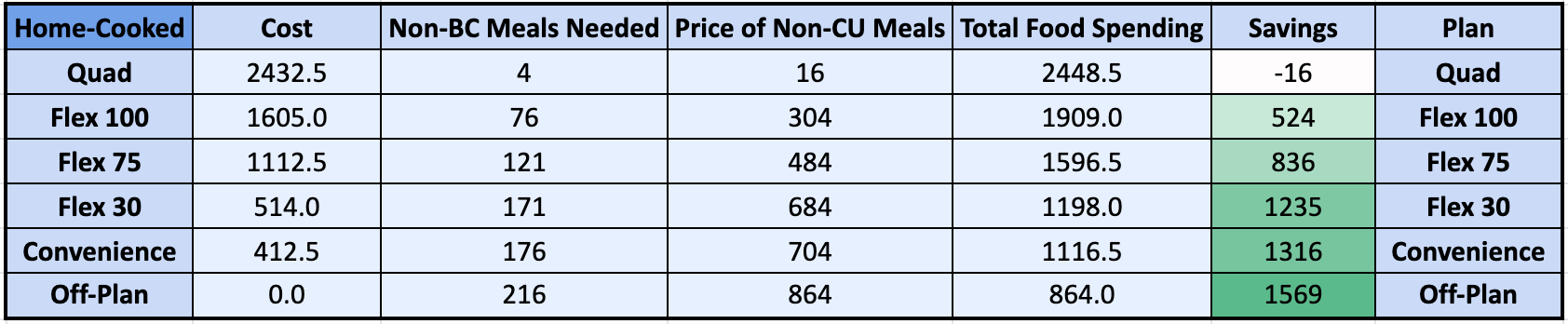

Option 2: Home cooking. You love to cook, have access to a kitchen, or otherwise don’t like doing out. If you are spending money on food, it’s groceries. For the sake of math, the average grocery run is $50. If you eat 2 meals a day, that’s 14 meals a week, or $3.57 per meal. I’ll round up to $4 per meal because most likely you are also buying coffee, snacks, and other pantry items. Given this…

Some notes about the tables:

Off-Plan means you did not purchase a meal plan.

Price of Non-CU/BC Meals: number of non-CU meals * cost per meal

Total food spending: What you are paying for the meal plan + what you are paying for non-CU meals

Savings: For CU: Cost of EZ1 – Total Food Spending. For BC: Cost of Quad Plan – Total Food Spending. Red means you’re losing money, green means you’re saving, and white means you aren’t changing your spending.

*If you had negative non-CU/BC meals (aka leftover meals at the end of the semester) I counted them as “0” in the calculation, as the colleges don’t refund you for those meals.

Now let’s analyze.

Columbia: If you are a restaurant-goer, plans C and D are a waste of money. You end up losing enough that you might as well just stick with the EZ1 plan. On the other hand, if you are planning on cooking most of your meals, C and D become the most financially viable, although you end up saving money with any meal plan if you cook at home. Obviously, no person is going to home cook every meal, and most people also won’t go out for every meal.

Barnard: For Barnard, again the meal plans are much simpler. The trend is easy to follow: the smaller your dining plan, the more you save if you cook at home. Quad is the only plan where you actually end up losing money if you cook at home, so if you have a kitchen but are trying to save money, Quad isn’t for you. If you’re a restraint-goer on the other hand, all of these plans will end up losing you money, and the smaller your dining plan, the more you lose.

•

Conclusions: Barnard’s meal plan is much simpler than Columbia’s. Buy the meal plan you think you’ll eat, and you will save money. For Columbia, take a look at your lifestyle and spending habits, in addition to your proximity to a kitchen. For both colleges, if you go off the meal plan completely and think you can cook for yourself, it is easily the cheapest option.

Editor’s note 4/28/20 12:37 pm: The estimated price of MoHi groceries was changed from $100/week to $50/week more accurately reflect student spending.

Image via Bwarchives

4 Comments

4 Comments

4 Comments

@Anonymous Does anyone remember how much it costs to pay for a meal at Ferris or John Jay wo a swipe?

@An interstate manager I want to say it’s like, $15?

@Anonymous I think the math for groceries is off – unless you’re shopping at Westside. $50/week is pretty good for about 15 meals in a week.

@author Thank you for pointing this out! If I was on campus I would have done a faux grocery run to get an average number, but since I’m not in NYC anymore I had to guesstimate. I updated the math in the spreadsheets to reflect that info :)